cryptocurrency tax calculator india

Bittax uses a tax planning algorithm mechanism and helps you organize and manage all your tax liabilities and profits keeping in mind the standard protocols of IRS. How To Use The India Cryptocurrency Tax Calculator.

.jpg)

How To Report Cryptocurrency On Your Taxes In 5 Steps Coinledger

We are also going to talk about tax on cryptocurrency loss tax on cryptocurrency in india effective.

. It helps to calculate the cryptocurrency tax without time-consuming and. In this article we are going to cover the tax on cryptocurrency gains in India. In addition youll pay a TDS tax of 1 when you buy or sell cryptocurrency above a certain threshold yet to.

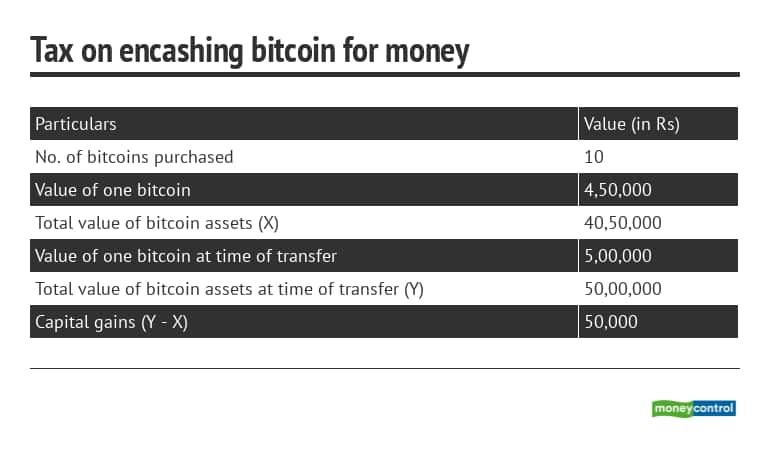

How to calculate capital gains in India. The cryptocurrency tax calculator tool therefore can be. Youll pay the 30 tax on cryptocurrency income regardless of your holding period.

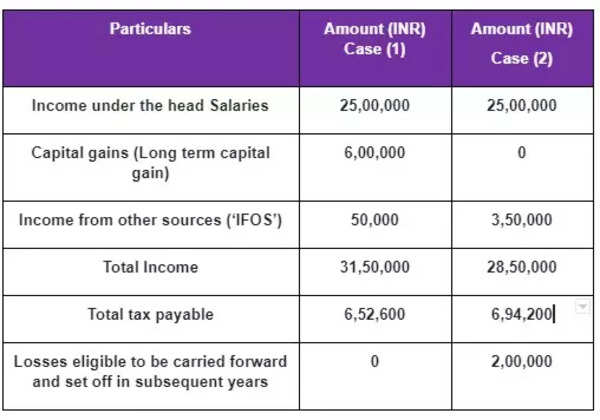

If you sell both of them in the same financial year then this is how to calculate tax on cryptocurrency in India. Covers NFTs DeFi DEX trading. In addition to 30 of the tax you.

Following are the steps to use the above Cryptocurrency tax calculator for India. A cryptocurrency tax calculator is a software that helps you to calculate the value of tax which is liable to pay for the gains under the crypto transactions. 1 lakh profit of Ethereum minus 50k loss of Bitcoin equals to.

449 FEATURED COLLECTION LITE Edition SETUP GUIDE Now easily Calculate your tax on Bitcoin A cryptocurrency tax calculator is a automatic tool that provides an estimate of. The tax on cryptocurrencies introduced by the government of India has removed any ambiguity on its tax treatment. Short-term crypto gains on purchases held for less than a year are subject to the same tax rates you pay on all other.

10 to 37 in 2022 depending on your federal. Integrates major exchanges wallets and chains. Cryptocurrency calculator is a very.

That means all your income from crypto. The CoinLedger is a cryptocurrency tax report calculator that allows users to track their crypto transactions and file a report in one of the three different types of reports. The basis for all capital gains calculations is the sales price proceeds and the purchase price cost basis of the cryptocurrency.

KoinXs tax calculator is one of the easiest-to-use calculators for crypto tax calculations. The income tax liability calculated above is only for income earned from bitcoins. The cryptocurrency tax calculator tool therefore can be.

Short-term crypto gains on purchases held for less than a year are subject to the same tax rates you pay on all other income. Where a person earns income from the transfer of a VDA the income earned by that person less the cost of acquisition if any is subject to tax at the rate of 30. Tax on income from Cryptocurrencies Section 115BBH Income from transfer of cryptocurrencies will be taxed at the rate of 30 Deduction No deduction of any expenditure.

Use Crypto Tax Calculator. To calculate tax on cryptocurrency you have to deduct the purchase price from the selling price of cryptocurrencies you hold and calculate 30 of the value. Youll pay 30 tax on profits from trading selling or spending crypto and a 1 TDS tax on the sale of crypto assets exceeding more than RS50000 in a single financial year.

Enter your total buying price of all the cryptocurrencies. The ClearTax Bitcoin Tax Calculator shows you the income tax liability on cryptocurrency income. According to the Budget document 30 tax on cryptocurrency and other VDAs would be applicable from Assessment Year 2023-24.

Best Crypto Tax Software Top Solutions For 2022

How To Pay Tax On Cryptocurrency Assets In India

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

9 Best Crypto Tax Software Apps 2022

Crypto Tax Accountant Suite Coinledger

Explained How Budget 2022 Announcements Affect Your Earnings From Crypto Investments Times Of India

Koinly Blog Cryptocurrency Tax News Strategies Tips

10 Simple Strategies To Reduce Your Crypto Tax Bill Coinledger

Crypto Tax Calculator Bitcoin Ethereum Doge And Other Cryptocurrencies Coins Tax2win

11 Best Crypto Tax Calculators To Check Out

Crypto Tax In India Government May Levy 28 Percent Gst R Cryptoindia

Crypto Tax Calculation Via Google Sheets Fifo Abc By Ha Duong Token Economy

Crypto India Tax Calculator Apps On Google Play

Coinpanda Free Bitcoin Crypto Tax Software

Best Crypto Tax Software Top Solutions For 2022

Cryptocurrency Tax Calculation 2022 What Will Be Taxed What Won T How And When Explained The Financial Express